Triton veröffentlicht jährliche Berichte zum verantwortungsvollen Investieren, um Nachhaltigkeitsinitiativen, Daten und Aktualisierungen, sowohl auf Unternehmensebene als auch in den Portfoliounternehmen, detailliert darzustellen. Darüber hinaus veröffentlichen wir regelmäßig Sustainability Spotlight-Berichte, die sich mit spezifischen Nachhaltigkeitsthemen befassen.

Die Einbettung von Nachhaltigkeit in den Investitionszyklus

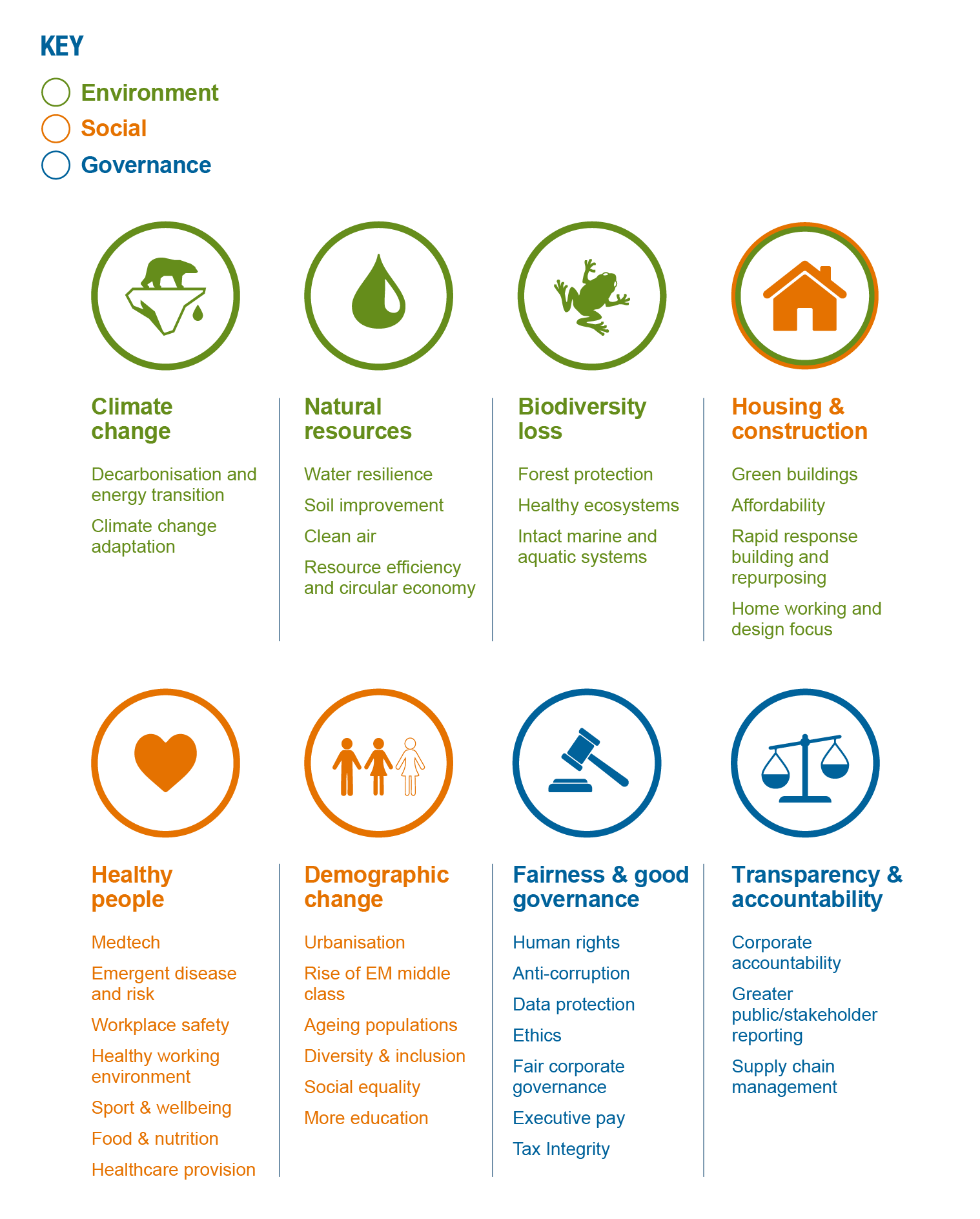

Die Investition in Nachhaltigkeits-Megatrends

Nachhaltigkeitsbezogene Offenlegung

Sustainable Finance Disclosure Regulation (SFDR)

Triton Investments Management SARL (the ‘Company’) is an authorised alternative investment fund manager (AIFM), duly approved and supervised by the Luxembourg Supervisory Authority for the Financial Sector (Commission de Surveillance du Secteur Financier, the CSSF).

As an EU AIFM, the Company is regulated under Sustainable Finance Disclosure Regulation (SFDR) and makes the following disclosures in accordance with Articles 3(1), 4(1)(a) and 5(1) of the SFDR.

The Company has delegated portfolio management of the funds it manages to a Triton entity, which receives the benefit of investment advice from other Triton advisers.

Article 3: Sustainability risk policies

The Company has implemented a Sustainability Policy which sets out how sustainability risks are integrated into its investment decision-making process and portfolio management activities. The SFDR defines sustainability risk as an environmental, social or governance event or condition that, if present, may result in a material negative impact on the value of the relevant fund's investments.

As part of pre-investment checks, inherent sustainability risks, adverse sustainability impacts and associated management activities are assessed, to the extent that information is available. For potential investments, where deemed necessary, relevant third-party advisers are engaged to conduct due diligence on the target company. A detailed evaluation of sustainability risks is undertaken as part of the due diligence process that then feeds into investment decision-making.

Sustainability risks for existing investments are continuously monitored, leveraging relevant public and private data sources, where available. For equity investments, risks and opportunities are actively tracked via Triton’s Stewardship Programme. The sustainability team supports portfolio companies in ensuring:

- appropriate governance is in place on sustainability, including board oversight on sustainability risks;

- material sustainability risks are identified and managed as part of their Sustainability Action Plan; and

- transparency on material risks and associated processes, mitigating programmes and performance through periodic reporting to investors and public disclosure.

For further information, please review the Sustainability Policy and Sustainability Reports available on the website.

Article 4: Adverse sustainability impacts at entity level

The Company considers the principal adverse impacts (‘PAIs’) of its investment decisions on sustainability factors.

The Company monitors and evaluates a range of investee company impacts on sustainability factors. Principal adverse impacts are considered to relate to material, negative impacts of investment decisions on environmental, social and employee matters, respect for human rights, anti-corruption and anti-bribery matters.

The Company has ensured that sustainability considerations have been integrated through the investment cycle, from initial research to final exit of the investment. Sustainability forms an integral part of the due diligence process, including the identification of any material sustainability risks and potential principal adverse impacts relevant to the potential investment. The sustainability checklist in respect of prospective investments covers sustainability risks and opportunities including but not limited to the environment, climate, working conditions, human rights, labour rights, diversity, equity and inclusion, compliance, corruption and money laundering.

Investors may access to the Article 4 sustainability-related disclosures via the link below (please contact contact Triton Investor Relations for access):

Statement on principal adverse impacts of investment decisions on sustainability factors

Article 5: Remuneration policies in relation to the integration of sustainability risks

The Company applies a policy (the Remuneration Policy) governing the remuneration paid to its staff (the Staff), in line with regulatory requirements. The Remuneration Policy promotes sound and effective risk management and does not encourage risk-taking which is inconsistent with the risk profiles of the funds the Company manages.

The Remuneration Policy is aligned with the business strategy, objectives, values, and long-term interests of the Company as well as the funds it manages and includes measures to avoid conflicts of interest. The Staff’s remuneration may consist of a fixed and a variable component. While variable remuneration is discretionary, it is granted following a performance assessment which considers individual performance as well as business performance, future developments and risks related to the activity of the Company, the funds it manages and Triton more broadly. When assessing individual performance, both financial and non-financial criteria are considered. The Company is part of the wider Triton, which applies its Sustainability Policy. The Remuneration Policy is fully consistent with the Company’s and Triton’s approach to integrate sustainability risks and does not encourage excessive risk-taking with respect to sustainability risks.

To request other fund/product level disclosures, please contact Triton Investor Relations. Be sure to state the fund for which you are requesting the disclosure.

Die Nachhaltigkeitsziele (SDGs) der Vereinten Nationen (UN) haben eine Blaupause für eine wohlhabendere und nachhaltigere Welt erstellt.

Triton ist der Ansicht, dass Unternehmen eine wichtige Rolle bei der Förderung positiver sozialer und ökologischer Veränderungen spielen. Die SDGs helfen uns, unsere Nachhaltigkeitsmaßnahmen zu identifizieren und zu priorisieren sowie messbare Auswirkungen im Hinblick auf unsere Ziele zu demonstrieren. Wir haben unsere wesentlichen Nachhaltigkeitsthemenmit den SDGs in Einklang gebracht, zu denen Triton und seine Portfoliounternehmen den größten Beitrag leisten können. Die relevanten SDG-Ziele, sind unten aufgeführt.

Unsere SDG-Ziele umfassen: 8.4 schrittweise Verbesserung der weltweiten Ressourceneffizienz in Konsum und Produktion bis 2030 und Bemühungen, Wirtschaftswachstum von Umweltzerstörung zu entkoppeln, 8.7 Sofortige und wirksame Maßnahmen ergreifen, um Zwangsarbeit auszurotten, moderne Sklaverei und Menschenhandel zu beenden und 8.8 Arbeitskräfte schützen, Rechte und Förderung eines sicheren Arbeitsumfelds für alle Arbeitnehmer.

Unser SDG-Ziel: 10.2 Bis 2020 die soziale, wirtschaftliche und politische Inklusion aller zu stärken und zu fördern, unabhängig von Alter, Geschlecht, Behinderung, Rasse, ethnischer Zugehörigkeit, Herkunft, Religion oder wirtschaftlichem oder sonstigem Status.

Unsere SDG-Ziele: 12.5 Bis 2030 das Abfallaufkommen durch Vermeidung, Reduzierung, Recycling und Wiederverwendung erheblich zu reduzieren und 12.7 nachhaltige Beschaffungspraktiken im Einklang mit nationalen Richtlinien und Prioritäten zu fördern.

Unsere SDG-Ziele: 13.1 Stärkung der Widerstandsfähigkeit und Anpassungsfähigkeit gegenüber klimabedingten Gefahren und Naturkatastrophen in allen Ländern und 13.2 Integration von Klimaschutzmaßnahmen in Richtlinien, Strategien und Planungen.

Unsere SDG-Ziele: 16.5 Korruption und Bestechung in all ihren Formen deutlich zu reduzieren und 16.6 effektive, rechenschaftspflichtige und transparente Institutionen auf allen Ebenen zu entwickeln.

Prinzipien für verantwortungsvolles Investieren (PRI)

Triton ist seit 2012 Unterzeichner der von den Vereinten Nationen unterstützten Prinzipien für verantwortungsvolles Investieren (PRI) und wurde bei der Bewertung im Jahr 2020 mit einem A+-Rating für die Module „Strategie und Governance” sowie „Private Equity” ausgezeichnet.

Als verantwortungsbewusster Investor engagiert sich Triton auch aktiv in Nachhaltigkeitsthemen im Rahmen von verschiedenen Brancheninitiativen:

Weitere Nachhaltigkeitsinitiativen und Engagements

BVCA (Mitglied der Responsible Investment Advisory Group)

Invest Europe (Mitglied der Core Group des Responsible Investment Roundtable und der Responsible Investment Advisory Group)

Initiative Climate International (Gründungsmitglied und Mitvorsitzender des europäischen Netzwerks, Mitglied des Lenkungsausschusses des internationalen Netzwerks)

Unsere Richtlinie für verantwortungsvolles Investieren

Bei Triton streben wir danach, Portfoliounternehmen im Hinblick auf langfristige Nachhaltigkeit und zum Nutzen verschiedener Interessengruppen zu fördern und zu verbessern. Daher erkennen wir die Bedeutung von Nachhaltigkeitsthemen an, um Wertsteigerungen für unsere Investoren, Portfoliounternehmen und die Gemeinschaften, in denen unsere Portfoliounternehmen tätig sind, zu erzielen.

Lesen Sie hier unsere Richtlinie für verantwortungsvolles Investieren (in englischer Sprache)